10% VAT on cross-border e-commerce transactions

- Levied to Indonesian customers

- On consumption of movies and music streaming services, mobile apps, online games, and other intangible goods and services

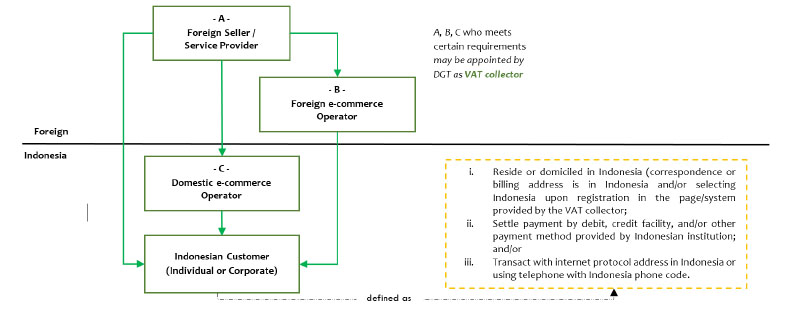

- Foreign e-commerce companies to be appointed as VAT collector

- Effective 1 July 2020

Mechanism

- VAT is liable upon consumption of taxable intangible goods and/or taxable services from outside Indonesia customs area through electronic system by Indonesia customers.

- VAT is collected upon payment by Customer, where VAT collector to issue VAT collection slip that can be in the form of: commercial invoice, billing, order receipt, or other documents.

- VAT collector to settle collected VAT by the end of the following month to the state’s treasury account. VAT collector may settle the VAT in: Rupiah, USD, or other foreign currency as determined by DGT.

- VAT collector must electronically submit report on the VAT collection, quarterly for 3 periods. DGT may request VAT collector to submit transaction-details report for every 1 calendar year.

Intangible Goods and Services

- Intangible goods, including but not limited to:

- The use of or the right to use any copyright of literary, artistic or scientific work, patent, design or model, plan, secret formula or process, trademark, or the form of intellectual/industrial property right, or other any kind of right.

- The use of or the right to use motion picture films, film or video tape for television broadcasting, or sound tape for radio broadcasting.

- Digital goods are any intangible goods in the form of electronic or digital information, including goods as the result of conversion or transformation or goods originally in the form of electronic, including but not limited to software, multimedia, and/or electronic data.

- Services include:

- any taxable services and digital services, i.e. services sent through internet or electronic network, that are automatic or having less human intervention, and impossible to ensuring without information technology, including but not limited to software-based services.

Your Contacts

- Tomy Harsono

+62 811 9196 939

tomy.harsono@consulthink.co.id

This publication is intended for general information only and should not be interpreted as substitute to any of our professional advices. All of information contained in this publication refers to the featured regulation as per the date of this publication.

info@consulthink.co.id

www.consulthink.co.id

Consulthink LinkedIn

+62 21 506 789 68